Portuguese energy multinational Galp has announced the sale of its 10% stake in the consortium exploring Area 4 of the Rovuma Basin, located in Cabo Delgado province, Mozambique. The decision, revealed last May, is part of Galp’s strategy to focus its investments on high-yield, low-cost and low-carbon projects.

The sale of Galp’s exploration and production assets in Mozambique was made to the Abu Dhabi National Oil Company (ADNOC) for 650 million dollars, the equivalent of 41 billion meticais, according to the current exchange rate. Galp’s CEO, Filipe Silva, justified the decision in an interview with Energy Connects, explaining that the company seeks to crystallize value, reduce risks and focus on higher return initiatives, in line with its sustainable growth strategy.

“We are committed to reducing risk and growing from low-cost, low-carbon intensity projects, while transforming our integrated positions,” said Silva. He also pointed out that these strategic decisions resulted in a year-on-year increase of 16% in Galp’s net profit in the second quarter of 2024, totaling 299 million euros, despite the volatile commodity price environment.

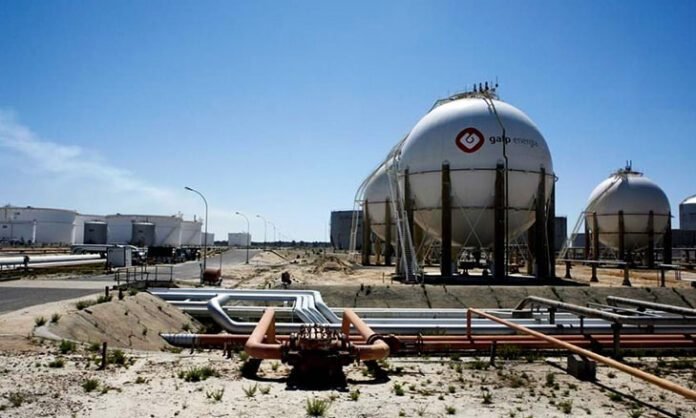

Galp began its activities in Mozambique in 2007, when it signed an agreement with Italy’s Eni and Empresa Nacional de Hidrocarbonetos (ENH) to explore Area 4, known for its water depth of up to 2,600 meters and for being one of the world’s most promising natural gas production projects.

Galp’s 10% stake, now sold, was part of a consortium in which ENH and South Korean company Kogas hold similar stakes, while the remaining 70% belongs to Mozambique Rovuma Venture, a joint venture made up of Eni, ExxonMobil and China National Petroleum Corporation.

In August, the Competition Regulatory Authority (ARC) approved the transaction, stating that the sale will not have a negative impact on the natural gas extraction and liquefaction markets, nor on the large-scale sale of LNG. Nazário Bangalane, president of the National Petroleum Institute (INP), considered Galp’s exit to be an expected and common move in projects of this magnitude, stressing that the concessionaires are free to negotiate their stakes.