Vista Group Holding announced on Thursday (08) the conclusion of the acquisition of 100% of Banco Société Générale Moçambique S.A., significantly expanding its presence on the African continent. With the acquisition, the Mozambican bank, which currently operates with eight branches, will now be known as Vista Bank Moçambique.

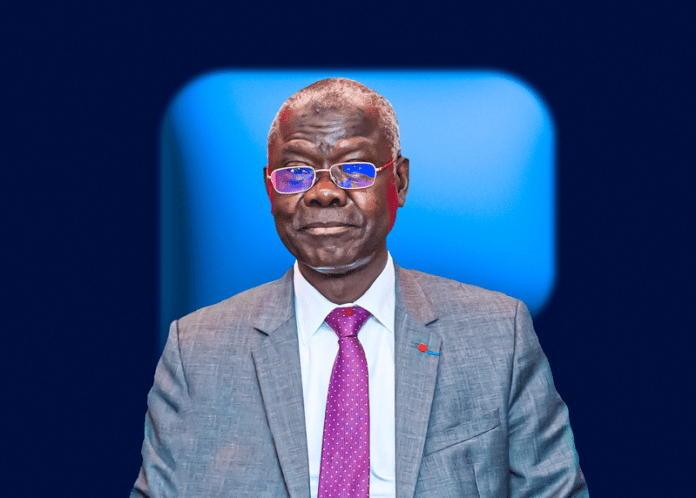

With this change, Banco Vista Moçambique will now be headed by Yao Kouassi, an Ivorian citizen, who has been appointed Managing Director of Vista Group Holding, and whose duties in this capacity will begin in January 2024.

In this context, Profile spoke to Yao Kouassi, who talked about the group’s trajectory and how this acquisition in Mozambique fits into Vista’s global strategy.

Profile Mozambique: Yao Kouassi, the recent acquisition of Banco Société Générale Moçambique S.A. by Vista Group Holding marks a new phase of expansion for the group in Africa. What prompted this acquisition and what are your expectations for the future in Mozambique?

Yao Kouassi: This acquisition is a strategic step in our mission to become a world-class pan-African financial services group. Mozambique offers a market with significant potential for economic growth, and we are confident that our investment here will pay off.

The country is at an important moment of development and, as a group, we have identified great opportunities to expand and improve financial inclusion.

PM: Vista Group Holding was created in 2016 and has grown significantly since then. Can you tell us a bit about the group’s trajectory and how this acquisition in Mozambique fits into Vista’s global strategy?

YK: In fact, Vista Group Holding was founded in 2016, and we began our journey by acquiring some branches of FIB Bank in West Africa, in regions that were facing the Ebola crisis, which represented a considerable challenge. Despite the difficulties, we managed to restructure these banks into profitable financial institutions.

With this success, our focus turned to other opportunities on the continent. It was in this context that we acquired BNP Paribas branches in Guinea and Burkina Faso, strengthening our presence in Africa.

PM: What criteria were used to choose Mozambique as the next step in Vista’s expansion?

YK: Before we make any investment, we carry out a detailed analysis of the market, considering growth potential, market depth and profitability opportunities. Mozambique stood out as a promising market with great potential for development, especially in the financial sector.

Our decision to acquire Banco Société Générale Moçambique S.A., rather than create a bank from scratch, was based on the institution’s solidity and track record, which will allow us to speed up the investment and integration process.

PM: In addition to banking expansion, what other strategies does Vista Group Holding intend to implement in Mozambique?

YK: Our global strategy involves not only expanding banking services, but also developing other complementary areas, such as insurance. The Vista group already operates five banks and two insurance companies in West Africa, and we intend to replicate this model in Mozambique.

We are planning to launch an insurance subsidiary in the country to offer a full range of financial solutions. In addition, we are committed to supporting small and medium-sized enterprises (SMEs) and promoting financial inclusion, both through traditional banking services and microfinance.

It is important to note that the transition process includes the complete replacement of the visual identity of the former Société Générale, and will be implemented over the next 12 months.

PM: What are your long-term goals for Vista Group Holding in Africa?

YK: Our aim is to be present in 25 African countries by 2026. We are currently in advanced negotiations to acquire more banking subsidiaries in different regions, including southern African countries such as Madagascar.

With these expansions, we hope to cover a wide range of markets, reaching around 288 branches and employing around 4,000 staff by the end of this year. We want Vista to become a leading financial institution in Africa, run by Africans and for Africans, with international standards of excellence.

PM: Finally, how will Vista Bank Mozambique position itself in the local market?

YK: We want Vista Bank Mozambique to be a major player in the country’s financial sector, not just following the trends, but leading the market.

We have a talented and experienced local team, and we will bring our international expertise to ensure that the bank becomes a reference in financial services in the Mozambican market. We are here to make a difference, supporting all sectors of the economy and contributing to the country’s sustainable development.

About Grupo Vista

Grupo Vista is a financial services holding company dedicated to becoming a pan-African financial institution of global reference, committed to economic and financial inclusion in Africa. In partnership with several international financial institutions, the Group has implemented a growth strategy focused on the Small and Medium Enterprise (SME) segment, offering services such as leasing, factoring, meso finance, trade and supply chain finance, and specific banking services for women, among others.

With a clear ambition to capitalize on all the opportunities in its markets, Grupo Vista is determined to consolidate its position as a financial institution of choice, standing out by offering innovative banking and insurance products.