Preliminary data from the Balance of Payments Report for the third quarter of 2023 indicates that the Mozambican economy recorded a remarkable 94.1% reduction in net external financing needs, with a combined current and capital account deficit of 18.1 million USD.

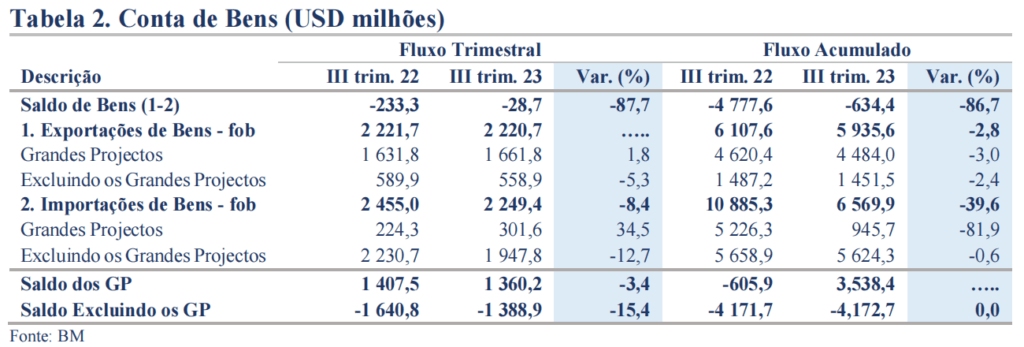

This significant achievement resulted mainly from a 74.6% reduction in the current account deficit, reaching 116.3 million USD. Meanwhile, the negative balance on the goods account fell by 87.7%, driven by a decrease in imports from companies unrelated to major projects of around 283 million dollars.

The improvement in the current account was also influenced by a 37.2% decrease in the services balance and a 27.6% increase in the secondary income balance surplus. In cumulative terms, the combined deficit fell by 82.9% to 945 million dollars.

On the other hand, the inflow of resources into the financial account increased by 242.1 million USD, mainly due to the growth of financial flows in Foreign Direct Investment, totaling 2.2 million USD.

Mozambique concluded transactions with an overall surplus of 6.4 million USD. The Central Bank’s reserve assets increased by 6.3 million USD, with gross international reserves reaching 3,163.1 million USD, solidly covering 3.1 and 3.8 months of imports of goods and services, including and excluding major projects.

Mozambique’s net debtor position vis-à-vis the rest of the world improved by 0.5% to 68,823.2 million USD. This progress reflects the increase in external assets by 12.1% to 17,479.7 million USD, while external liabilities increased by 1.8% to 86,302.9 million USD.

These positive results signal an optimistic outlook for the Mozambican economic panorama, highlighting resilience and efficiency in financial management.