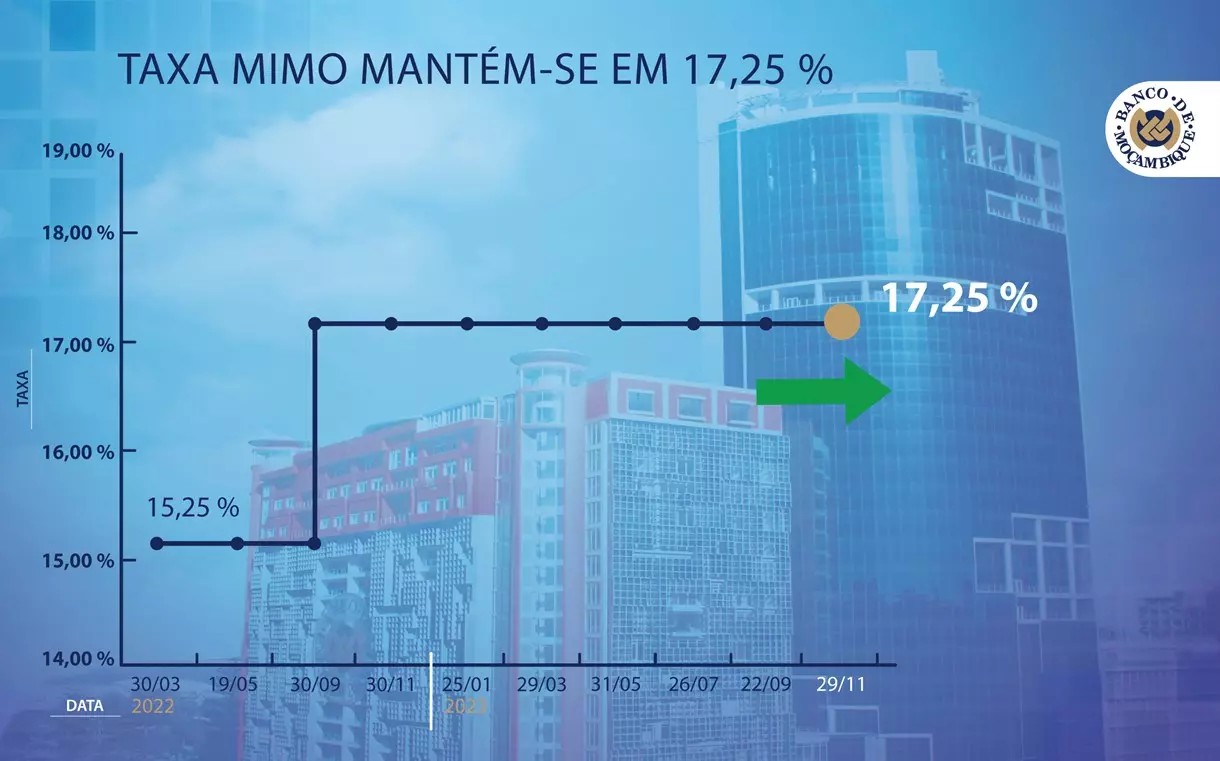

The Monetary Policy Committee (CPMO) of the Bank of Mozambique decided to maintain the monetary policy interest rate, MIMO, at 17.25 per cent. This decision is underpinned by the emergence of new risks and uncertainties associated with inflation projections, particularly the potential impact of the current conflict in the Middle East on international fuel and food prices.

The inflation outlook remains in the single digits over the medium term. In October 2023, annual inflation rose to 4.8 per cent, after 4.6 per cent in September. This development is mainly explained by the increase in the prices of food and alcoholic beverages. Underlying inflation, which excludes fruit and vegetables and goods with administered prices, also increased. For the medium term, the outlook is for single-digit inflation, reflecting above all the stability of the Metical and the impact of the measures being taken by the CPMO.

The risks and uncertainties underlying inflation projections continue to worsen. Domestically, pressure on public finances and uncertainties about the evolution and effects of extreme weather events prevail. On the external front, in addition to the conflict between Russia and Ukraine, there are uncertainties about the prolongation and spread of the current conflict in the Middle East and its impact on international oil and food prices.

For the medium term, excluding liquefied natural gas (LNG), moderate economic growth is expected to continue. In the third quarter of 2023, excluding LNG, gross domestic product (GDP) is estimated to have grown by 3.3 per cent, after 3.1 per cent in the previous quarter. Including LNG, GDP growth accelerated to 5.9 per cent, after 4.7 per cent. In the medium term, it is expected that economic activity, excluding LNG production, will continue to recover, despite the uncertainties associated with the impacts of probable climatic events on agricultural production and various infrastructures. Meanwhile, the extractive industry will continue to contribute to the acceleration of economic growth.

The pressure on domestic public debt continues to increase. Domestic public indebtedness, excluding loan and lease contracts and outstanding liabilities, stands at 334.4 billion meticais, which represents an increase of 59.3 billion compared to December 2022.

The CPMO will continue to monitor the evolution of the risks and uncertainties associated with inflation projections, and will take the measures that are appropriate to the context.