The almond and oilseed market has aroused the interest of investors and agricultural producers due to its lucrative potential and the growing demand for natural and healthy products. Almonds, in particular, are widely used in the food, pharmaceutical and cosmetics industries, as well as being used for consumption.

The European Union (EU) is one of the main consumer markets for these products, offering significant opportunities for exporters wishing to expand their business internationally. However, entering this highly regulated market requires knowledge and preparation.

In this article, we will explore the reasons for investing in the almond and oilseed market and present the potential that Mozambique presents for entry into the sector.

Almonds and oilseeds sector: growth and evolution

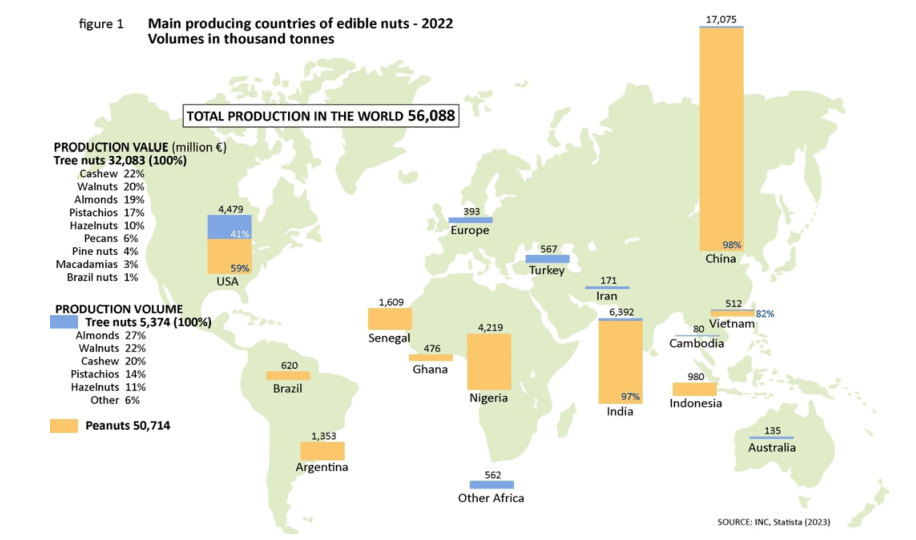

According to the INC, almond production has been concentrated mainly in high- and middle-income

high and middle income economies over the last decade. Between 2013 and 2022,

world production increased almost sixfold, from 3343 to 5374 thousand

tons. During this period, there was a compound annual growth rate of

of 5.8%, which meant an average annual increase in production of 250,600 tons.

In 2022, almonds accounted for 27% and 22% of the world’s production volume, respectively, followed by cashew nuts (20%), pistachios (14%) and hazelnuts (11%). Pine nuts, macadamias, pine kernels and Brazil nuts together accounted for the remaining 6%.

In the same year, the value of production was estimated at 32.083 million euros, of which

cashew nuts took the lion’s share of 22% (6.962 million euros)

The US has taken over most of the world’s almond production, with an average share of 36% over the last five seasons (2018/19-2022/23).

share of 36% over the last five seasons (2018/19-2022/23). Almonds, pistachios and

almonds were the most cultivated crops, accounting for 59 %, 22 % and 15 % of the world’s

US tree almond production, respectively.

Turkey is the second largest producer and accounts for 11 % of world production, with hazelnuts accounting for 63 % and pistachios for 15 %.

hazelnuts at 63% and pistachios at 30%.

Almond production in the “Other African countries” group was mainly

cashew nuts in West and East African countries (Ivory Coast, Burkina Faso, Mozambique and Tanzania).

Faso, Mozambique and Tanzania), while South Africa was an important producer of Macadamia and

Macadamia nuts and almonds. The highest annual growth rates between 2013 and 2022 were observed for almonds and macadamia at 9% each, followed by cashew nuts (7%). The production of pistachios and pine nuts increased by an average of 5% per year, while almonds and hazelnuts grew at an annual rate of 3%.

Growth in the world market for almonds and oilseeds

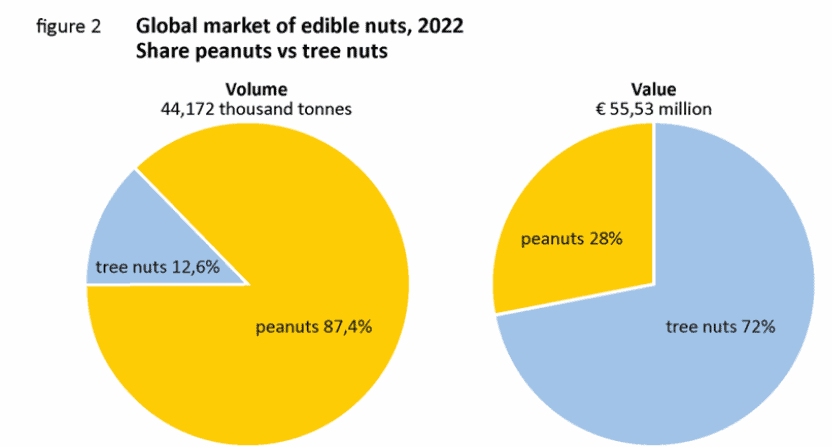

In 2022, the global market for almonds was estimated at 44,172 thousand tons, which

55.532 million. Peanuts accounted for the largest share

(87.4%) of the world almond market by volume.

Almonds accounted for 72 % of the market by value, and were sold mainly in Western countries. Over the last decade, the global almond market has grown steadily. There have been changes in consumers’ eating habits in North America, Europe and Asia, with an increasing number of vegetarians and flexitarians using

almonds as a meat substitute. In addition, the growing popularity of

as an on-the-go snack with healthy properties has also increased the growth of the almond industry.

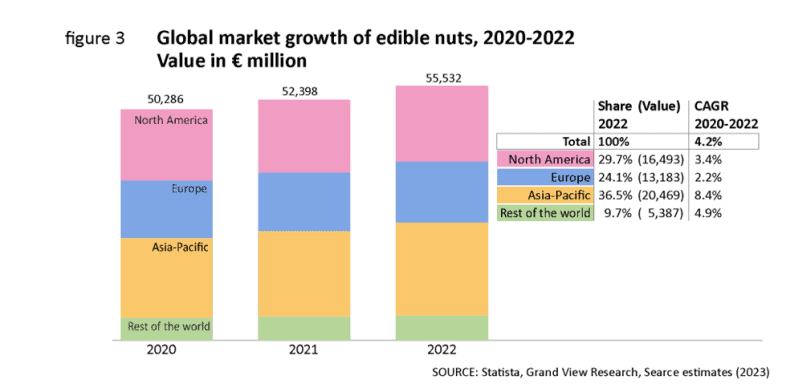

has also increased the growth of the almond industry. Between 2020 and 2022, the

global market increased at a CAGR of 4.2 %, from EUR 50,286 million to EUR

55,532 million.

World almond market

In terms of value, almonds accounted for 72 % of the world almond market.

almonds. In 2022, this market amounted to 39.983 million euros. The consumption of

nuts is mainly concentrated in high- and middle-income countries, according to the INC.

according to the INC.

The most popular nuts include almonds, which account for a quarter of the market in terms of value.

market in terms of value. Almonds were followed by cashew nuts (18 %), almonds (17 %), pistachios (14 %), hazelnuts (13 %), macadamia nuts, pine nuts, pine kernels and Brazil nuts.

In terms of volume, the following volumes and market shares were recorded in

2022:

– Almonds – 1571 thousand tons (31%)

– Almonds – 977 thousand tons (19%)

– Cashew nuts – 965 thousand tons (19%)

– Pistachios – 768 thousand tons (14%)

– Hazelnuts – 549 thousand tons (11%)

– Pine nuts – 147 thousand tons (3%)

– Macadamias – 64 thousand tons (1%)

– Pine kernels – 48 thousand tons (1%)

– Brazil nuts – 8 thousand tons (1%).

Opportunities for Mozambique in EU markets

In 2020, according to the World Bank, agricultural land (% of land area) in Mozambique reached 52.7

in Mozambique reached 52.7% in 2020. Mozambique has huge tracts of

fertile agricultural land and a very large rural population living under poverty levels, requiring

poverty levels, demanding resources and ways of life. Agriculture accounted for more than 25% of Mozambique’s GDP in 2019 and employed

almost 4.3 million families, representing more than 70% of the country’s workforce.

Rural livelihoods in Mozambique depend predominantly on agriculture.

agriculture. The majority of producers are small-scale farmers and most of their

rain-fed, which makes it susceptible to rising temperatures and variable rainfall.

and variable rainfall.

Types of oilseeds in Mozambique

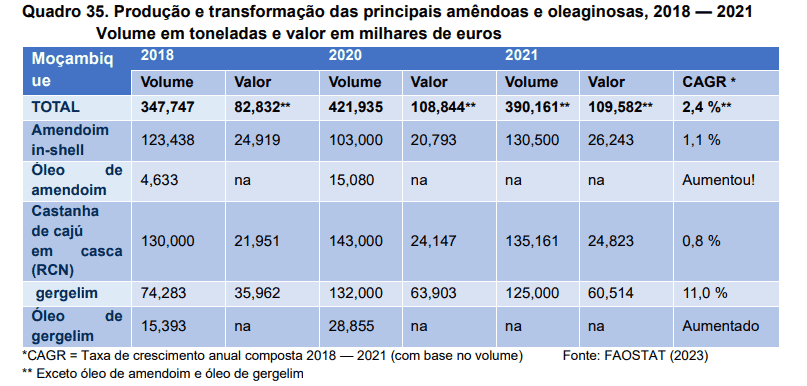

The total area harvested in Mozambique for the three main crops – cashew nuts

(RCN), peanuts and sesame – totaled 706,000 ha in 2021. Around

54 % were used for groundnuts, according to the FAO. The areas harvested

of raw cashew nuts (RCN) and sesame accounted for around 23 % of this total.

total. The area harvested for macadamias is estimated at between 6 and 10 thousand ha. Mediterranean

almonds and pine nuts are also grown in Mozambique, although on a limited scale.

limited scale.

The estimated production of raw cashew nuts (RCN) was 135,000 tons.

As shown in Figure 30, when comparing production with the area harvested, the figures for

production of RCN oilseeds and sesame were significantly higher than those of peanuts.

than those of peanuts. One of the main reasons for this is that, in general, it takes

to produce one ton of groundnuts.

Groundnuts

Most groundnuts (in shell) are produced in the northern provinces of Nampula,

Zambézia and Cabo Delgado and in the southern provinces of Inhambane, Gaza and Maputo.

Peanut varieties

There are thousands of peanut cultivars, with the four most prevalent market groups being

prevalent:

– Spanish

– Runner

– Virginia

– Valencia.

Consumption and imports of almonds by type in key EU countries

Based on their size and good growth prospects, the following markets are selected

markets are selected:

– Germany

– France

– Spain

– Italy

– Netherlands

– Belgium

– Greece

– Poland

Production volume

In 2021, Mozambique produced around 130,000 peanuts (in shell) with an approximate value of 26,000 EUR. Peanut production represented a third of the total production of the three crops, which was 390,000 tons. Since 2018, peanut production has increased at a CAGR of 1.1 %. The decline in 2020 can be attributed to Cyclone Eloise. Most of the peanuts produced are used to extract oil for domestic consumption and for export. As a high-quality cooking oil, it is an essential source of protein for both humans and animals. In addition, the oil provides much-needed foreign currency. Peanut oil production more than tripled between 2018 and 2020, from 4633 to 15,010 tons.

For more information, see the full study at: https://bit.ly/3I7RMkQ